Maximising Your Extra RM1000: Home Loan Overpayment vs. High-Yield Savings Account (HYSA)

Introduction: The RM1000 Question

You have an extra RM1,000 available for one month. The crucial decision is: should you use this lump sum to reduce the interest charges on your flexi loan (home loan overpayment) or deposit it into a High-Yield Savings Account (HYSA), such as RYT Bank, to earn a daily interest of 4% per annum? This analysis, using our Extra Payment Calculator, provides a clear direction in under two minutes.

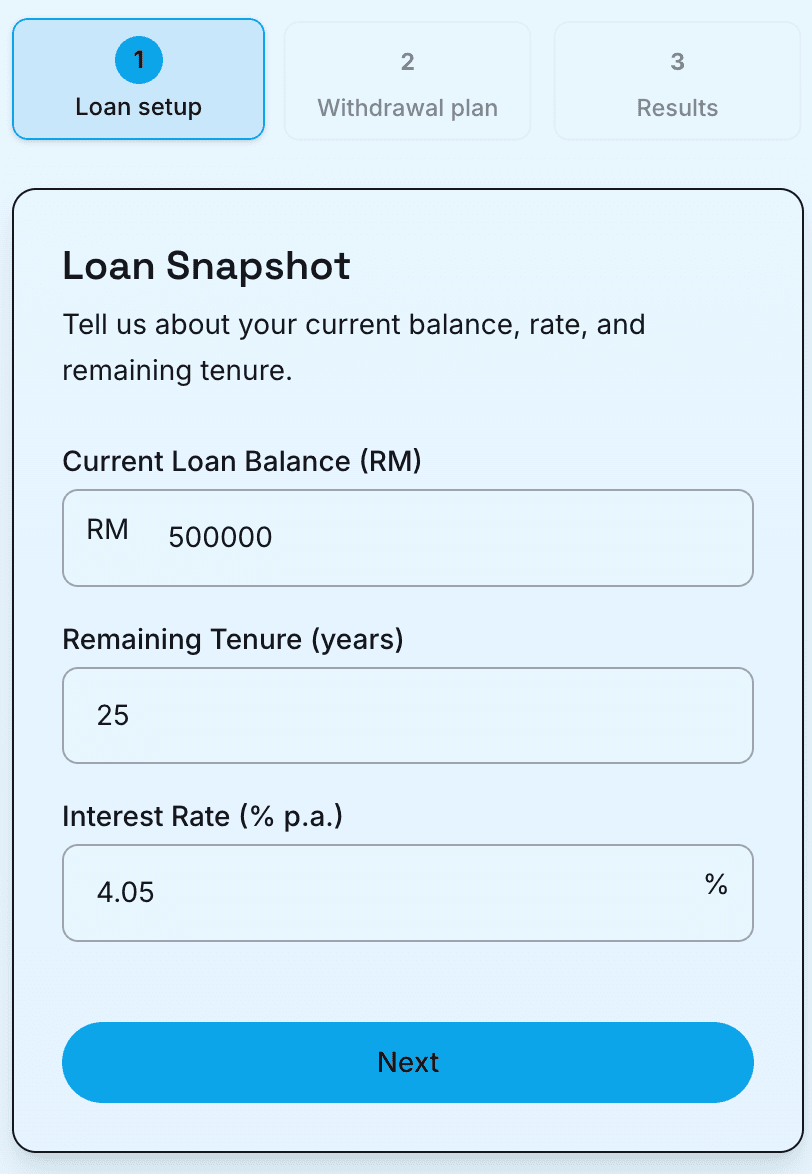

Step 1: Setting Up Your Loan Profile

- Current Loan Balance

- Remaining Loan Tenure

- Applicable Interest Rate

This information allows the calculator to determine the exact monthly interest you are currently being charged.

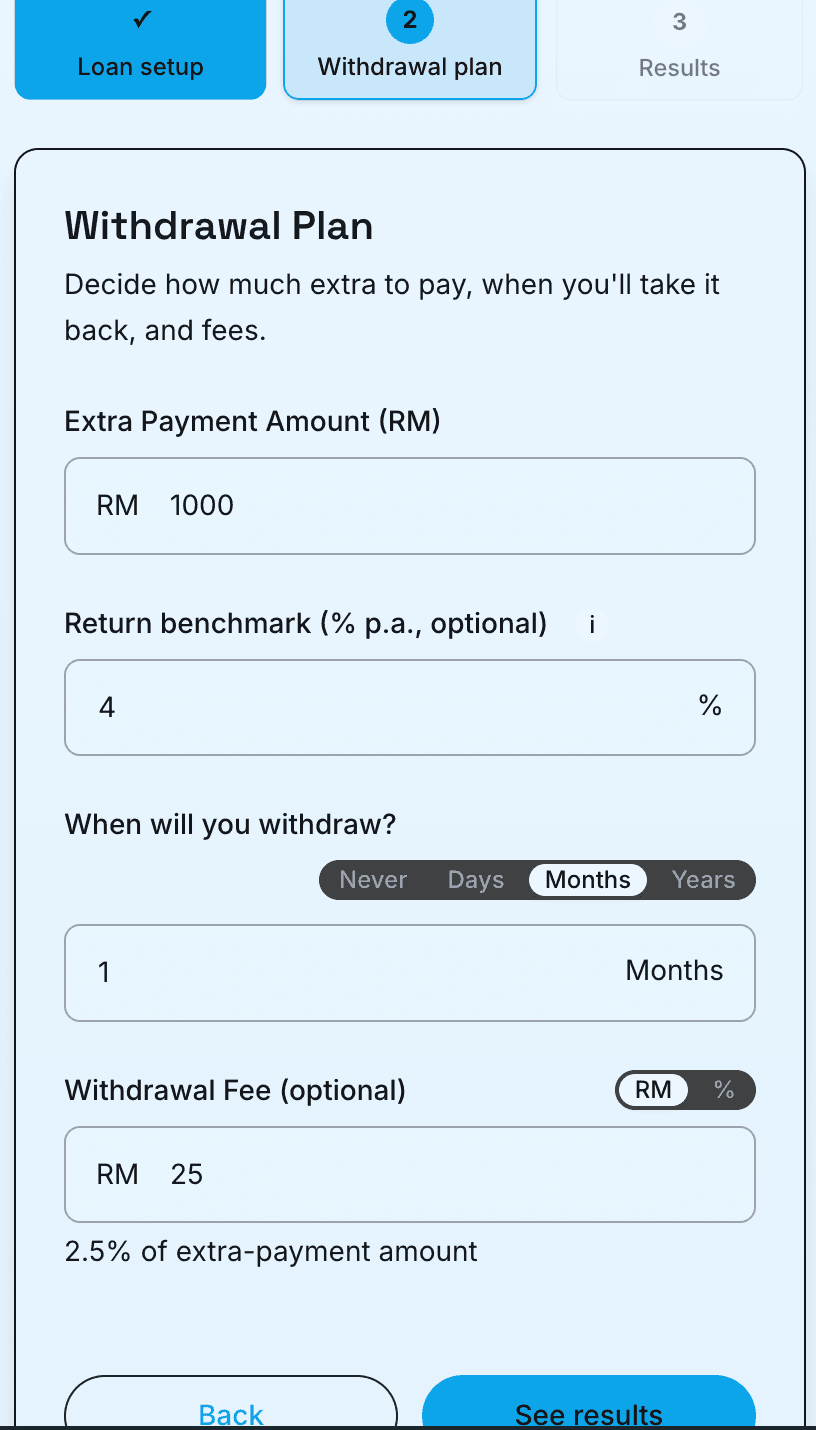

Step 2: Defining Your Savings and Withdrawal Strategy

- Payment/Deposit Amount: Input the extra RM1,000.

- Return Benchmark: Enter the competitive HYSA interest rate, such as RYT Bank's 4% p.a.

- Holding Duration: Specify how long the money will be kept in the account (in this scenario, 1 month).

- Withdrawal Fees: Critically, include any bank charges for withdrawals. In Malaysia, bank withdrawal fees can range from RM17.50 to RM50. Additionally, be mindful of minimum balance requirements (e.g., RM5,000 for some Maybank products) and any monthly withdrawal limits.

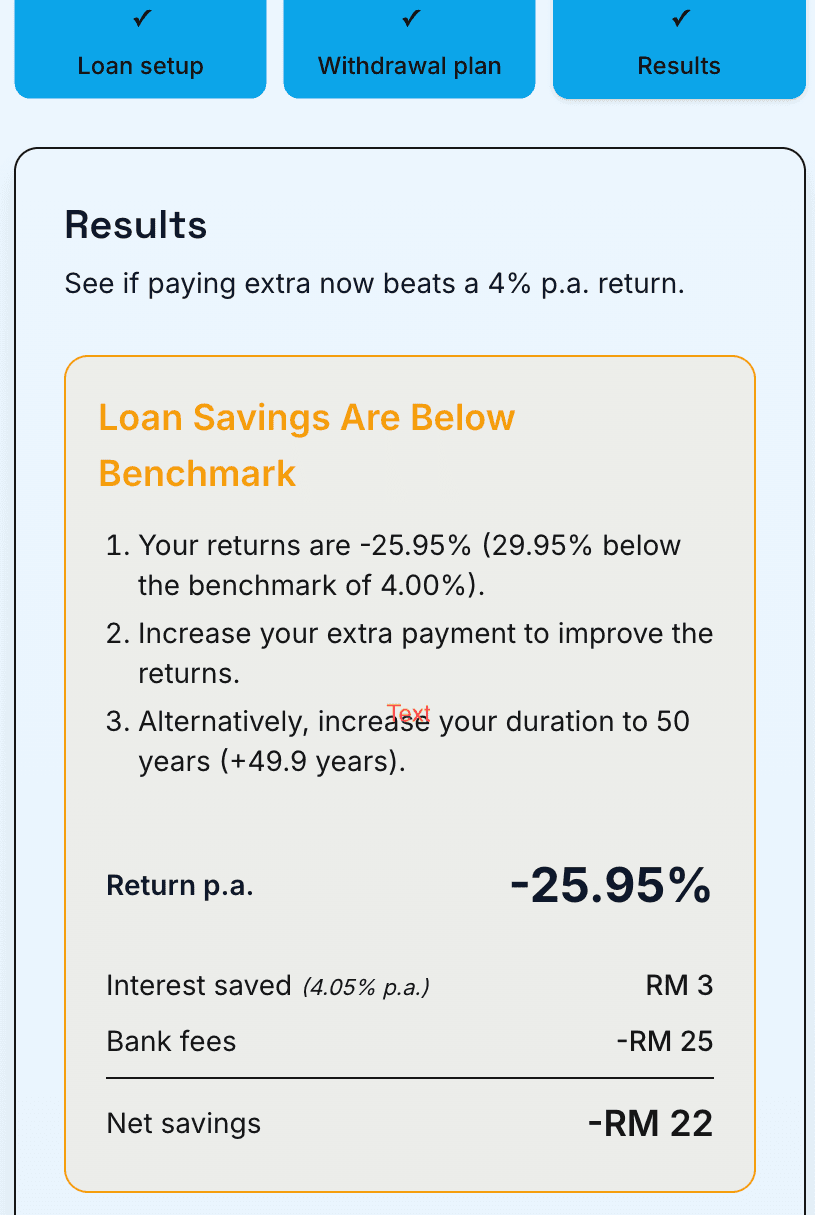

Step 3: Analysing the Results

The analysis shows that the withdrawal fees incurred when accessing the funds from the loan account significantly erode any interest savings. Even though the interest rate on the home loan is typically higher than the 4% offered by RYT Bank, the fee structure makes the HYSA more advantageous. According to the calculator's findings, you would need to hold the RM1,000 for at least 50 years for the flexi loan's interest savings to surpass the returns from RYT Bank.

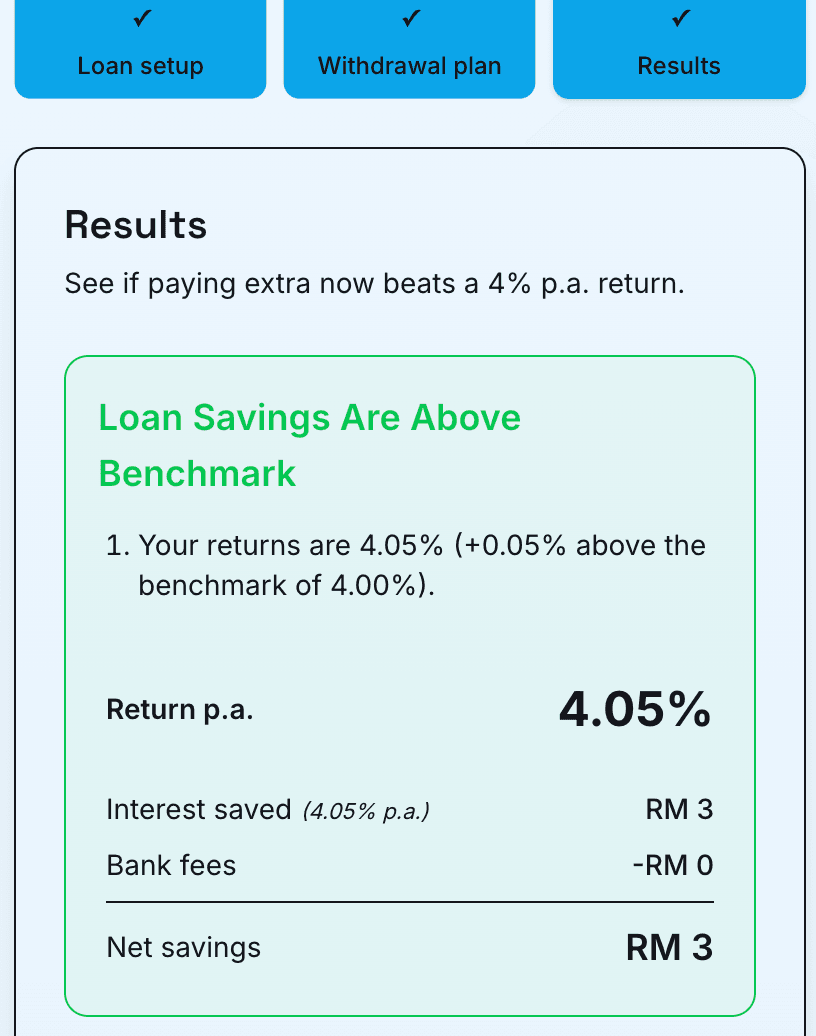

Important Note: If there were absolutely no withdrawal fees associated with the home loan overpayment, then depositing the RM1,000 into the home loan would be the more financially sound choice.

Conclusion: The Fine Print Matters

While the intuitive financial move is often to address high-interest debt first, the reality of bank charges and loan fine print can change the entire equation. In this case, the withdrawal fees rendered the home loan overpayment less attractive than the interest earned from the HYSA. Utilize our Extra Payment Calculator to test various durations and amounts, ensuring your short term financial decisions are optimised.