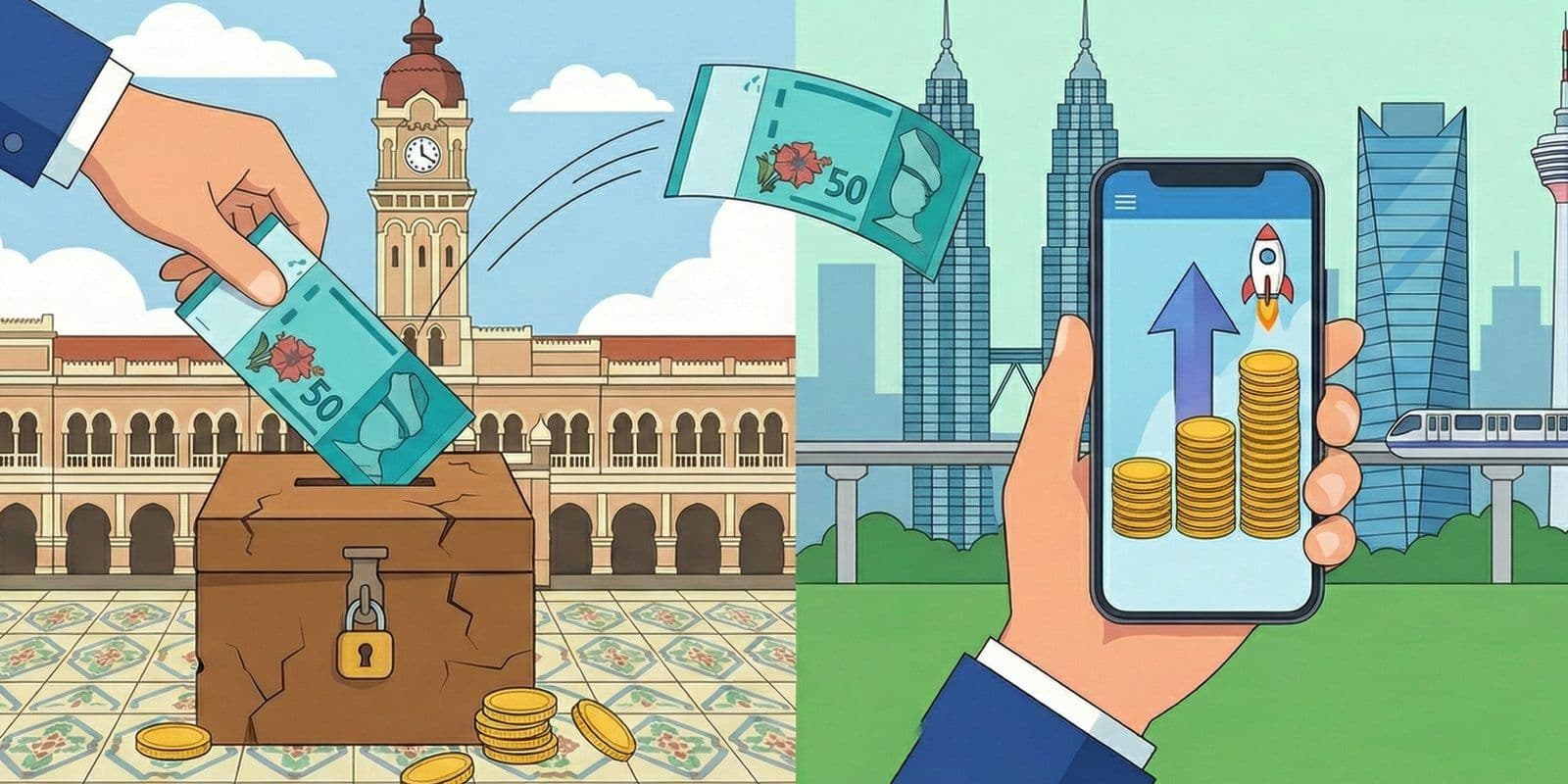

Leaving a spare RM50 in a standard savings account often means missing out on potential growth. While many traditional banks offer minimal interest rates, high-yield alternatives allow your money to work harder from the very first day. Moving these small amounts ensures that you are maximizing every cent of your hard-earned income. Keeping cash in an account with low returns is a choice that costs you money over time due to inflation. You can learn more about where to park your initial savings in this article on GXBank vs. Under Your Pillow: Where to Hide Your First RM1,000.

The Invisible Loss of Traditional Savings

The Invisible Loss of Traditional Savings

Leaving a spare RM50 in a standard savings account often means missing out on potential growth. While many traditional banks offer minimal interest rates, high-yield alternatives allow your money to work harder from the very first day. Moving these small amounts ensures that you are maximizing every cent of your hard earned income. Keeping cash in an account with low returns is a choice that costs you money over time due to inflation. You can learn more about where to park your initial savings in this article on GXBank vs. Under Your Pillow: Where to Hide Your First RM1,000.

Monthly Gains Comparison

Modern digital banks in Malaysia have introduced competitive accounts that credit interest daily. This feature allows your RM50 to start earning immediately. The table below illustrates the difference in returns between a legacy bank and a high-yield savings account over a thirty day period.

| Feature | Traditional Savings Account | High-Yield Savings Account |

|---|---|---|

| Annual Interest Rate | 0.25% | 3.00% |

| RM50 Gains after 30 Days | RM 0.01 | RM 0.12 |

| Interest Frequency | Monthly or Quarterly | Daily |

| PIDM Protected | Yes | Yes |

Securing Your Financial Future

The security of your funds remains a primary concern when choosing a new platform. High-yield accounts offered by licensed digital banks are regulated by Bank Negara Malaysia. Furthermore, your deposits are protected by PIDM up to RM250,000 per depositor per bank. This protection provides peace of mind while you build your liquid reserves. Once you have moved your initial funds, you should use an Emergency Fund Calculator to determine your total savings goal. Building this buffer is a foundational step in any professional financial plan.

Your 2 Minutes Action Plan

- Open your current banking application to check your savings account interest rate.

- Transfer RM50 to a high-yield digital savings account to begin earning daily interest.

- Check your new balance tomorrow morning to see the first interest credit.