The Hidden Price of Flexible Cash

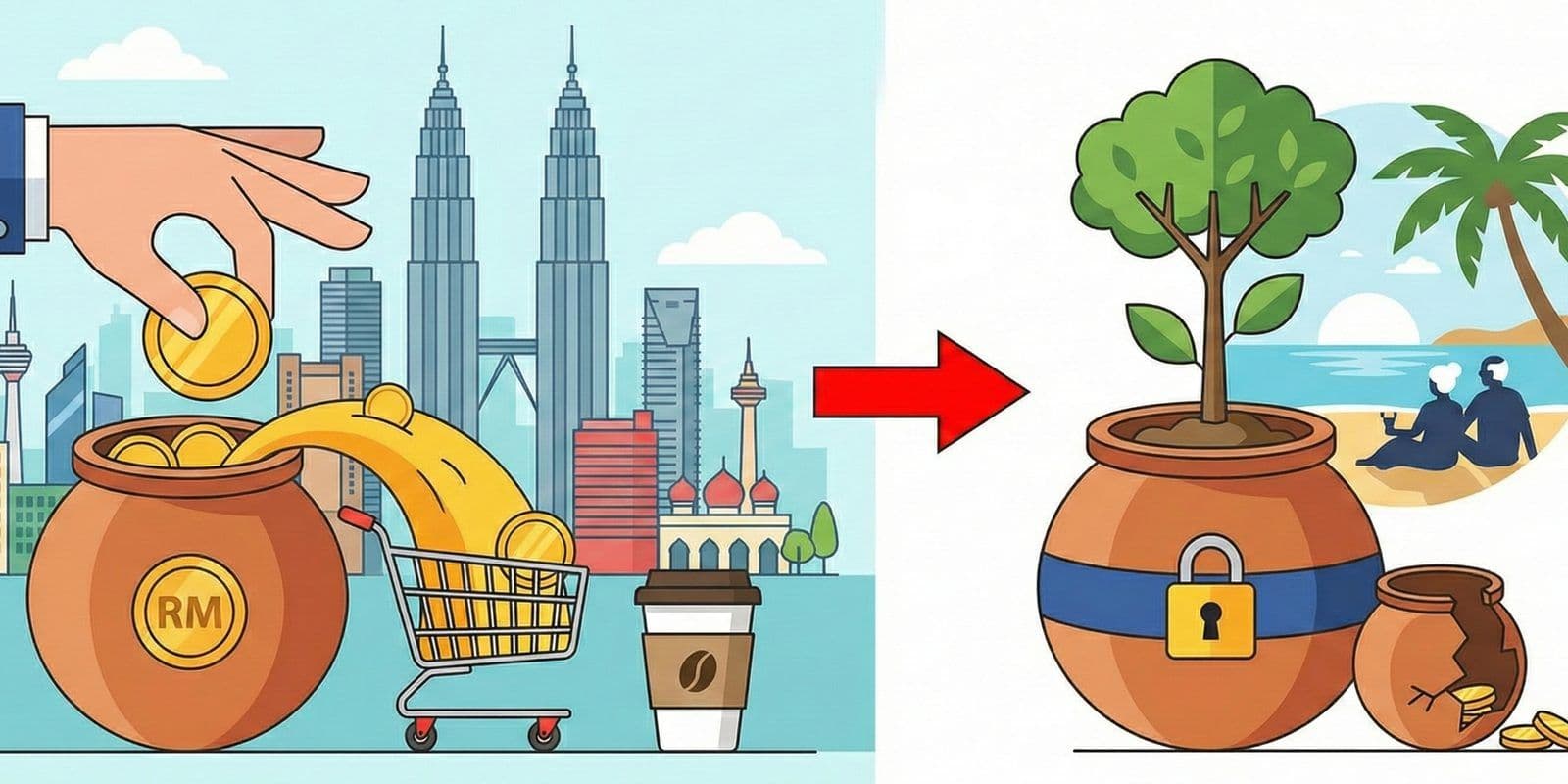

The 2024 launch of Akaun Fleksibel gave every Malaysian the power to withdraw retirement funds instantly. While this flexibility helps in genuine crises, it creates an expensive habit for many young professionals. Under the new 2026 Retirement Income Adequacy framework, the target for basic savings is now RM390,000. Every Ringgit you pull out today makes that goal significantly harder to reach. Withdrawing for lifestyle wants is a choice to trade your future comfort for a temporary thrill.

The True Cost of Early Access

When you withdraw from your EPF, you are not just taking your principal. You are stealing the future dividends that money would have earned. The following table illustrates how much a single withdrawal actually costs your future self, assuming a consistent 5.9% annual dividend.

| Withdrawal Amount Today | Value Lost (5 Years) | Value Lost (10 Years) | Value Lost (20 Years) |

|---|---|---|---|

| RM1,000 | RM1,332 | RM1,774 | RM3,146 |

| RM5,000 | RM6,659 | RM8,869 | RM15,732 |

The Compounding Damage

As shown above, a RM5,000 withdrawal today results in a massive RM13,265 hole in your retirement nest egg. This is why we call it the most expensive cash in your portfolio. You can verify how these shifts affect your total nest egg by using the Retirement Calculator.

Your Essential Avenue Audit

Before you tap into your EPF, you must exhaust every other financial avenue. This discipline ensures that your retirement fund remains protected as a sacred pillar of your wealth. You should treat the EPF as a glass box that you only break in a life-altering emergency. If you are struggling with daily expenses, read our guide on Why My RM5,000 Gaji Feels Like RM3,500: The Hidden Killers to find the leaks in your budget first.

Your 5-Minute Action Plan

- Review your high yield savings account for any available liquid emergency funds.

- List three non-essential items you can sell on secondhand platforms for quick cash.

- Check for any zero percent interest credit card cash advance offers as a temporary bridge.

- Calculate the 20-year cost of your desired withdrawal using the table above.

- If you still choose to withdraw, set a calendar reminder to "repay" the amount into your EPF via voluntary contributions.